Payday Loans: are there any alternatives?

The wrong way to use a payday loan Many people have a negative perception of payday loans and lenders, and this is largely due to the amount of horror stories that have emerged about them over the years. Most of…

Buy Now, Pay For it Later

We’re stepping up to warn of the threat that Buy Now Pay Later (BNPL) schemes pose to consumers. Companies such as Klarna, Laybuy and Clearpay allow consumers to make online purchases and spread the cost through instalments over an agreed…

PayPlan named Debt Advice Provider of the Year

The PayPlan team recently celebrated after being named the 2019 Debt Advice Provider of the Year at Credit Strategy’s industry leading Collections & Customer Service (CCS) Awards.Now in its thirteenth year, the CCS Awards champions outstanding achievements of organisations, teams…

What is a Challenger Bank?

Challenger banks are typically small banks aiming to challenge the longer-established bigger banks, such as the ‘big four’ (Barclays, HSBC, Lloyds Banking Group, and The Royal Bank of Scotland Group). Examples of challenger banks include Monzo, Starling and Tandem, but…

Couples who make a claim for pension credit NOW could save up to £7,280* per year

Pension credit is changing as of May 15th 2019Are you living with a partner? Is one of you aged over 65 and the other under 65? If so, then there could be some big changes happening with any new pension…

Why guarantor loans can land you in debt

Are Payday Loans Becoming a Thing of the Past?

The recent collapse of Wonga has been ugly and well-publicised. The payday lender had a less than favourable reputation, and was seen by many as a business model that preyed on people who were either desperate or didn’t understand what…

Welsh Government set to abolish Council Tax Imprisonment

PayPlan’s reaction to Welsh Government abolishment of council taxAlistair Chisholm, head of advice sector policy and partnerships at PayPlan, wrote an industry report ‘I can’t believe we still do that: council tax report’ in November 2017. The report, a joint…

PayPlan announced as finalist for Debt Advice Provider of the Year

PayPlan have been shortlisted for Debt Advice Provider of the Year for the Credit Awards 2018, which has been the industry’s flagship event for over 20 years. They have been recognised for their work in creating an end to end…

FCA warns of interest-only mortgages

Around 1 in 5 of all mortgages are interest-only and the industry’s regulator is worried that consumers are at risk of losing their homes. The Financial Conduct Authority (FCA) is urging people to speak to their mortgage providers if they…

New credit card rules estimated to save consumers millions

The Financial Conduct Authority (FCA) has published new rules for the credit card market and is estimating consumers will save between £310 million and £1.3 billion a year in lower interest charges. The changes announced today will offer more protection…

Interest rates hikes set to hit struggling homeowners hard

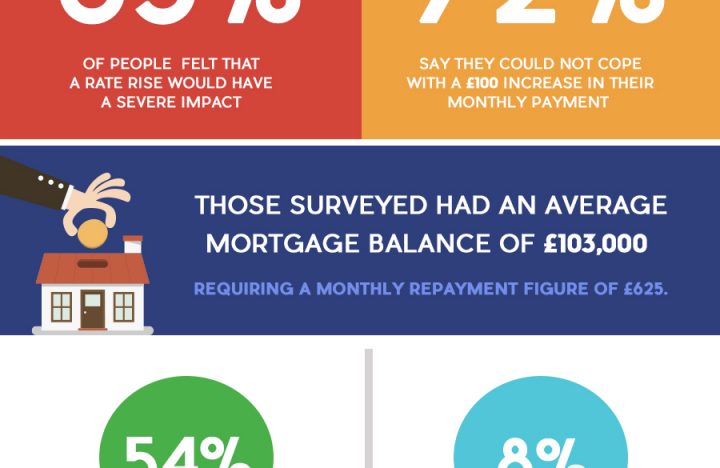

Households on variable rate mortgages with the lowest levels of disposable income are at risk of sinking further into debt if interest rates increase by 0.25 per cent.PayPlan has warned that even this modest rise could have a ‘devastating’ impact…

Nine in 10 homeowners are worried about rise in interest rates

In the news this week: Bills, borrowing and debts growing

Earlier this week the Financial Conduct Authority (FCA) warned of a pronounced build-up of debt among young people.

What do the bankruptcy changes mean for you?

The application process and fees have changed for bankruptcy. Today we look at what changes have occurred and what they mean for you.

New data reveals Essex has the highest average debt in the UK

PayPlan have revealed new debt figures to show the top 10 counties in the UK with the highest average debt figures and Essex was revealed to have the highest debt level. According to the data 1212 people from the area used…

SELF-EMPLOYED AT RISK OF ALMOST 40% MORE PERSONAL DEBT

Self-employed people clock up nearly 40 per cent more personal debt than those who are on the payroll, according to PayPlan's latest research.

ARE YOU WORRIED ABOUT THE RISE OF INTEREST RATES? YOU’RE NOT ALONE

In autumn this year we surveyed hundreds of homeowners already living on a tight budget asking how to a rise in interest rates would affect their finances.While the Bank of England held interest rates again, our survey revealed 72% of…

Pensioners Struggle to make ends meet

Almost a million people in the UK will die in debt, many of them pensioners who struggle daily to make ends meet. In today’s Daily Mirror reporter Tricia Phillips speaks to Jane Clack, our Money Advice Consultant, and PayPlan client David…