The Financial Struggles of Being a Single Parent

Table of contents

There are many reasons single parents struggle financially, and it’s nothing to be embarrassed about. Being a single parent is hard, especially when there’s only one monthly paycheck instead of two and you have to put more money into childcare whilst you go to work.

We’ve outlined some of the struggles you might have previously faced and how you can overcome them.

Paying the Bills

If you’re not careful, the cost of bills can continuously creep up. But did you know that it’s easy to bring them back down? Most suppliers will reduce the cost if you simply call them and ask. You must be out of contract to do this, but it’s proven to be very effective.

The other way you can reduce your bill payments is by switching suppliers. This is easier than it sounds and could save you a lot of money in a year. Visit the uSwitch website and see how much you could save.

Trying to Save

It can be almost impossible to save any money as a single parent. All of your money goes into the bills, the food shop or new shoes that your children constantly grow out of.

The best way to stay on top of your finances is to create a budget. Work out what needs to be paid each month, like rent, bills and food, and account for extras too like school lunches, any childcare costs, etc. Set aside an additional amount every month for ‘surprises’ like school trips, or additional swimming lessons. Whatever is left over can go into a savings account.

You can also look into earning cashback on your purchases through cashback websites. You can save lots of money this way on things that you need to buy.

Paying for Childcare

Two-parent families might be able to pick up their child before and after school. But what if you work late or work weekends? Paying for additional childcare can be expensive.

There are tons of options for getting a certain amount of childcare free or claiming tax-free childcare, where an extra 20% is put towards care.

You can also see if you’re eligible for Working Tax Credit, which could cover up to a huge 70% of your childcare costs. You need to work for at least 16 hours a week, and already pay for approved care.

Here are some ways you might be able to save extra money as a single parent:

- Get 25% off your council tax if your children are under 18 and you don’t live with another adult

- Claim Child Benefit

- Get a one-time payment of £500 from the Sure Start maternity grant for pregnant single mothers

- Apply for the 30 hours free childcare scheme, whereby your child aged 3 or 4 can have free childcare if you’re working

- Get up to £150 to go towards your child’s school uniform from the council

- Get a one-off £140 discount on your winter energy bill with the Warm Home Discount Scheme

It’s worth researching some of these ways you can save money over the year. Just look into whether you qualify and how you can apply.

Affording Days Out

If the cost of school lunches, music lessons and school uniforms aren’t enough, weekends can become even more expensive when you want to go on fun activities and days out.

A walk or a day at the beach is free but what about the cost of cinema trips or eating out?

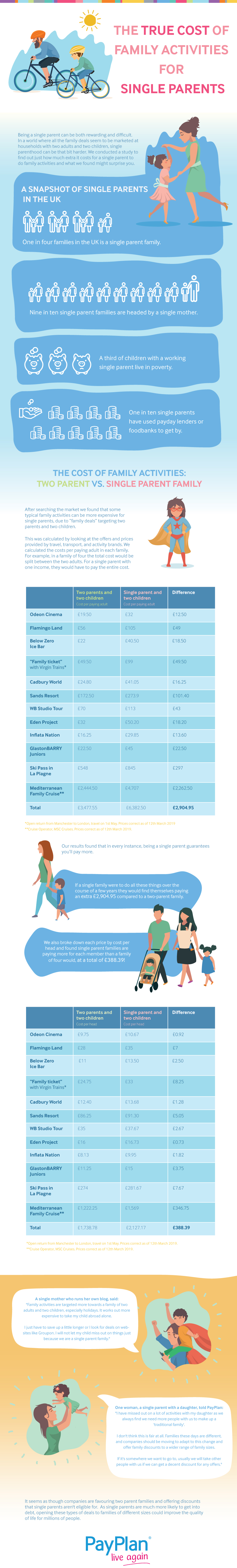

We wanted to find out if days out are more expensive for a single parent. Many attractions have a ‘Family Ticket’ that covers two adults and two children. But as a single parent, this option isn’t available to you and you have to pay per person, which could work out more expensive.

We created this graphic that shows the difference in price for two-parent families buying family tickets vs. single parents having to pay per person. You might be shocked by the results.

Sources:

https://www.gov.uk/browse/benefits/families

https://www.moneyadviceservice.org.uk/en/articles/help-with-childcare-costs